Thomas Kee's stock market crash! What does the Wall Street veteran forecast?

The Wall Street veteran forecast?

In the world of financial markets, it's rare for voices warning of a deep correction to gain traction at a time when the stock market is still holding at relatively high levels. However, Thomas Kee, a respected strategist and president of Stock Traders Daily, argues that right now is the time to prepare for something bigger - something that may resemble the panic of a dot-com or COVID crash... but with the potential for spectacular gains on the part of ready investors. What is it all about? We check.

The S&P 500 is in for a painful descent - by as much as 40%

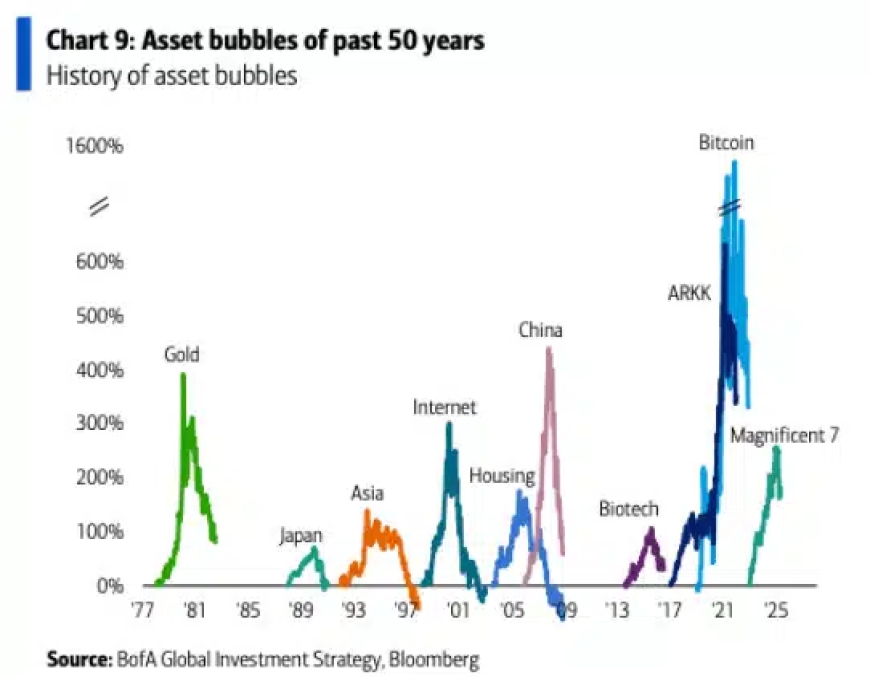

Although the S&P 500 index remains only 10% below its historic peak in February 2025, Thomas Kee leaves no illusions: this is just the beginning. According to his forecasts, the index needs to fall another 40% or so to return to so-called fair value. Today's valuations, he explains, are artificially inflated by years of cheap money, zero interest rates and fiscal cash overproduction.

The historical average valuation of the C/Z ratio for the S&P 500 index has hovered around 16 times earnings. Meanwhile, today, even after the correction, the market is trading at levels between 26 and 27 times. Before the recent declines, it was reaching almost 30 times earnings. Kee stresses that a true “cleansing” of the market can only take place by removing excess liquidity altogether - and there are real indications of this on the horizon.

New market cycle

One of the main catalysts for the upcoming “reset of valuations” is expected to be the Federal Reserve's ongoing balance sheet reduction. Kee points out that there has long been an outflow of excess funds from the market, but only changes in fiscal policy - such as the federal spending cuts announced by the Trump administration - will have a real impact on the economy and the perception of investment risk.

In addition, he points out, trade tariffs are playing a surprisingly positive role in helping the market regain its healthy caution. According to Kee, it is only now - after years of distortion - that the economy is beginning to function according to its natural cycle. And while this may mean pain in the stock market, in his view... that's where the opportunity lies.

Investment opportunity - but only for the prepared

At the center of Kee's approach is the CORE strategy, based on a rotation between cash and SPY ETFs - the world's most liquid stock market instrument. "We avoid market risk altogether, moving into cash in moments of danger. We come back when things start to get really ugly - and take out a few percent profit, then wait again," he explains.

Since 2019, his strategy has achieved an average annual return of 15.5% with extremely low volatility (beta of just 0.05). Importantly, it's not about beating the market - which has yielded an average of 17.2% per year over the same period - but about stability and minimizing risk.

“It's about weathering the storm and being ready when the biggest investment opportunity of the generation opens up,” Kee says.

"You can't build a sustainable economy based on stimulation and printing money. Capitalism has to work. And right now - with this mechanism coming back into play - there will be an opportunity that may not be repeated for decades."

Mark Spitznagel, of Universa Investments LP, recently expressed a similar belief.